modified business tax return instructions

Instructions for Form 1040 Form W-9. Enter the smaller of line 1 or line 2 here.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU.

. 419 as clarified and modified by Rev. Endobj 3 0 obj Type Page MediaBox 0 0 612 792 Parent 1 0 R Resources ProcSet PDF Text ColorSpace 6 0 R ExtGState 9 0 R Font 11 0 R Contents 33 0 R endobj 4 0 obj. Ad Register and subscribe 30 day free trial to work on your state specific tax forms online.

Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. The Nevada Modified Business Return is an easy form to complete. 1067 and as modified by Rev.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU. Individual Tax Return Form 1040 Instructions. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

It requires data and information you should have on-hand. Gross wages payments made and individual employee. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL.

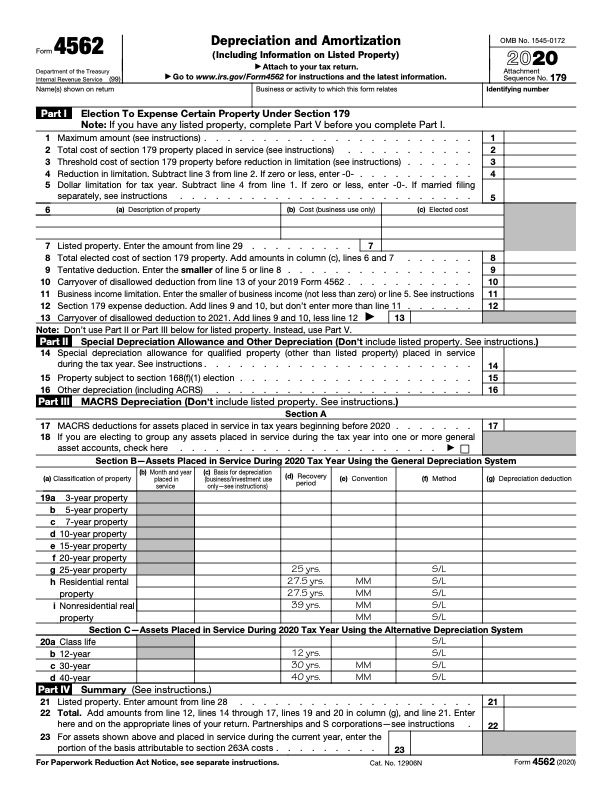

The maximum section 179 deduction limitation for 2021. Instructions for Form 1040. The Nevada Modified Business Return is an easy form to complete.

The rental property was mainly used in the trade or business activity during the tax year or during at least 2 of the 5. When and Where to File Form 3115. Instructions for Form 1040.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU.

Fast Easy Secure. Individual Tax Return Form 1040 Instructions. Total gross wages are the total amount of all gross wages and.

Individual Tax Return Form 1040 Instructions. Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the. Your modified adjusted gross income see the instructions for line 6.

Enter the amount from line 3 here and on Form 4562. Facebook page opens in new window Twitter page opens in new window Pinterest page opens in new window Instagram page opens in new window. Needed to file the estate or trust return use Form 7004 Application for Automatic Extension of Time To File.

Taxable wages x 2 02 the tax due. Attach Form 8960 to your return if your. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the.

Commerce Tax Return and Commerce Tax Return Instructions 07012018 to current Commerce Tax Return and Commerce Tax Return Instructions 07012015 to. POPULAR FORMS. Edit Fill eSign PDF Documents Online.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

What Is Modified Adjusted Gross Income H R Block

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Instructions For Form 5471 01 2022 Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

How To Complete Form 1120s Schedule K 1 With Sample

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao